Resources

MuniESG Insights | Focus on Physical Risk Disclosure: Manatee County, FL

Manatee County is in excellent fiscal shape but can adopt a more robust stance on its environmental impact reporting. We break this down for you using MuniCREDIT Online and MuniESG tools.

Manatee County, FL, recently came to market with a $219.335 million Revenue Improvement and Refunding Issue, Series 2022. We took a look at the County’s Official Statement and found the disclosure language on key physical risk issues to be less than optimal for this high-quality obligor.

Solid Financial Condition

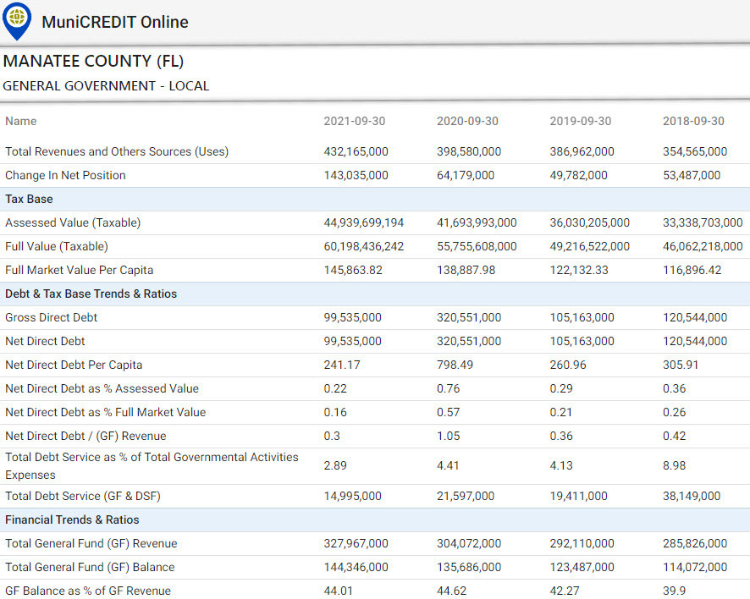

By most traditional yardsticks, Manatee County is in excellent fiscal shape, as befits a credit rated Aa1/AA+ by Moody’s and S&P, respectively. A quick lookup of this obligor in our MuniCREDIT Online application will confirm this. In fact, debt trends show a sharp improvement in FY2021, as shown in Table 1.

Modest Carbon Transition Risk Exposure

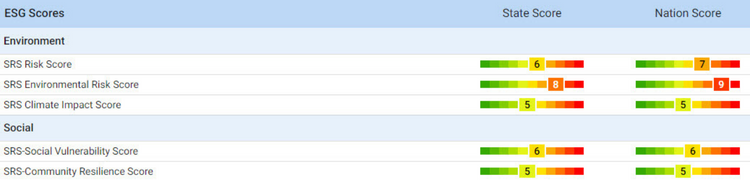

In terms of “Environmental” factors (the “E” in “ESG”), the County’s strong tax base and ample fiscal resources should help it address any potential costs related to the transition to a net zero economy. Manatee’s potential carbon transition liability of about $60.7 million a year as estimated by our partners at Spatial Risk Systems (“SRS”) looks quite manageable when compared to the size of its tax base (assessed value) and its budget (total revenues). As a result, the County compares quite well with its peers within the State of Florida and ranks in the top decile (score of “1”) versus other counties nationwide, as shown in Table 2.

Mixed Physical Risk Exposure

When it comes to Sunshine State obligors, many of us automatically think about severe climate risk, e.g., hurricanes, sea level rise, etc. Surprisingly, Manatee County’s Climate Impact score is only average when compared to other counties within the state and within the US, as shown in Table 3.

Bear in mind that a better-than-expected Climate Impact score does not mean the frequency of occurrence of a natural disaster is low. The SRS Climate Impact scale takes into account both the probability of occurrence for chronic and acute hazards and the estimated annual loss from such natural disasters. In Manatee’s case, a high frequency of occurrence is offset by a low expected annual loss, resulting in a middle-of-the-pack score of “5”.

Aside from Climate Impact, the other component of a municipal issuer’s Physical Risk is its Environmental Risk (not to be confused with the overall “Environmental” umbrella term, the “E” in “ESG”). The SRS Environmental Risk score strictly measures an obligor’s exposure to local pollution, toxic waste dumps etc. By this measure, Manatee County does not fare well, with relative scores of “8” and “9” versus its in-state and national peers, respectively.

Upon further investigation, it appears that water quality is among the key drivers of the County’s unfavorable Environmental Risk score. A 2021 report by Calusa Waterkeeper, a non-profit organization dedicated to the protection of Southwestern Florida’s near-shore waters and their watersheds, ranked Manatee as the worst among the nine counties in Southwest Florida in terms of water quality impairment.

In our opinion, environmental factors can have a material impact on an issuer’s intermediate and long-term economic growth. Pollution-related litigation can have an even more immediate impact on County finances if it involves the county’s own facilities or if it requires public remediation efforts. A recognition and discussion of the county’s ongoing water quality issues would have been appreciated by investors in the Series 2022 bonds.

To be fair, the Official Statement does mention last year’s environmental disaster at Piney Point, the site of a local fertilizer plant, when toxic wastewater from the plant was found to be leaking into Tampa Bay. However, this was treated as a one-off event and not as part of an ongoing disclosure regime designed to keep investors informed on a regular basis (Note: users of our MuniPOINTS and Filings Summary products can easily follow any development related to Piney Point through our “News” feed, which provides behind-paywall licensed access to local news sources such as the Bradenton Herald).

Conclusion

Disclosure of ESG-related risk factors is certainly a topic that is still evolving in the municipal market, even as market participants await clear guidance from the MSRB. The Regulatory Board has already made it clear it considers any risk factor considered material by investors, whether ESG-related or not, to be within the purview of existing risk disclosure guidelines established by the SEC.

Manatee County has a strong history of financial transparency, having earned a Certificate of Achievement for Excellence in Financial Reporting from the Government Finance Officers Association (“GFOA”) for 42 consecutive years. The GFOA has recently recommended more robust “Environmental” disclosure in its “ESG Best Practice” publication. Manatee County can follow suit and cement its already strong reputation by taking its Environmental Risk disclosure beyond the stock language one can still find in its bond offering documents.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, and on our MuniESG scores, including details on the 18 sub-components of the Climate Impact Score (hurricanes, tornadoes, wildfire, etc.), please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice.

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.