Resources

MuniCREDIT Insights | Moving the Chains: Texas A&M University

Texas A&M recently came to market with a new bond. Using MuniCREDIT Online, we examine the school’s recent credit trend and ESG disclosure.

A few days ago, the Texas A&M Aggies came close to pulling a second consecutive upset of the Alabama Crimson Tides, the number one college football team in the country. While the current season has been a bit of a roller coaster for Aggies fans, investors in this leading public university’s tax-exempt bonds have enjoyed a much smoother ride.

Strong Financials But High Dependence on State Support

Texas A&M recently came to market with a $208.52 million Revenue Financing System issue, Series 2022. The deal earned a top rating of Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively.

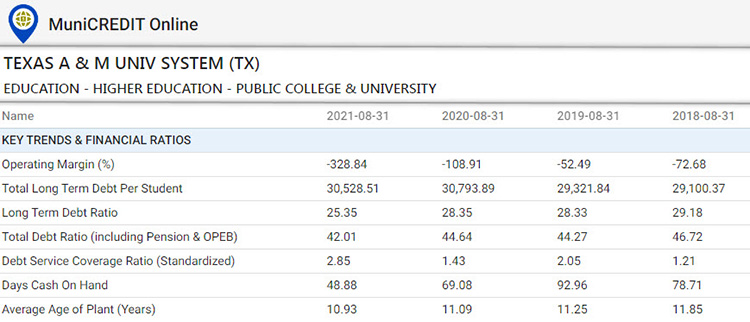

Let’s take a peek at the school’s recent credit trend through our MuniCREDIT Online web-based application, as seen in Table 1 below:

Like many other public higher education institutions around the country, Texas A&M felt the negative impact of the Covid crisis primarily in FY2020, followed by a sharp rebound in FY2021 due to increased governmental aid.

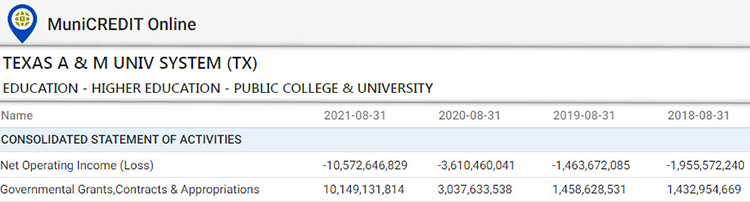

Yet, even with the massive federal and state aid related to the pandemic, one can’t help but notice the large and still growing operating deficit and a rather steady decline in liquidity (Days Cash On Hand declined to only 49 days in FY2021 versus 93 days in FY2019). In fact, the school has historically relied on governmental grants and appropriations to make up for its operating shortfalls, as shown in Table 2.

The large increase in governmental revenue sources in FY2021 included $740 million in Covid-related federal aid.

Although the high dependence on State appropriations may be of some concern, the school can reasonably rely on continuing State support for the foreseeable future. In fact, many State agencies have actually been integrated into the Texas A&M System. The latest addition occurred in September 2019, when the Texas Division of Emergency Management (“TDEM”) became the eighth State agency to join the A&M system, just months before the onset of the pandemic.

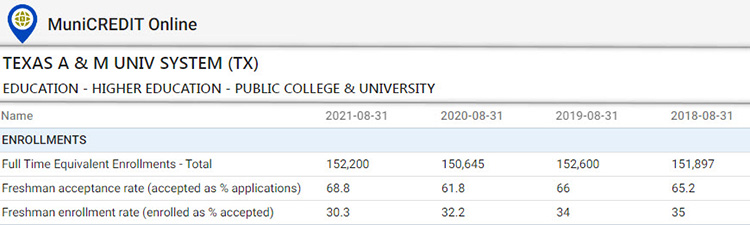

Student enrollments at Texas A&M remained relatively stable throughout the pandemic, registering only a small decline of 1.3% in FY2020, followed by a 1.0% recovery in FY2021 (Table 3).

ESG Disclosure

This being a Texas institution, one would not expect to see much disclosure in terms of ESG factors, and this was in fact the case in the Official Statement for the Series 2022 bonds.

Under the “Weather & Environmental Events” heading, reference was made to the infamous 2021 winter storm which caused massive disruption to the operations of Texas utilities. The University estimates it incurred losses of about $33 million as a result of this event, a sum which is expected to be covered by insurance.

Under “Cybersecurity,” the school simply reports that it conforms to the cybersecurity framework prescribed by the Texas Department of Information Resources, with a five-year internal audit cycle. On a positive note, University President M. Katherine Banks announced last month the founding of the Texas A&M Global Cyber Research Institute, to “conduct high-impact research on threats to and protections for the nation’s security and economy while uniquely preparing students to excel in the ever-growing cybersecurity field.” Will this potential cutting-edge cybersecurity research will find its way into the school’s own IT practices? Only time will tell.

Conclusion

Where Texas goes, Texas A&M will follow. The close relationship between the state and the University can, ironically, be viewed as both a source of stability and of potential volatility going forward. The financial rebound in FY2021 was driven in large part by extraordinary state and federal support related to the pandemic (e.g., TDEM funding) and it would be interesting to see where the University’s margins settle once the non-recurrent funding starts to normalize. Let’s hope Texas A&M will keep moving the chains, on the football field as well as on the financial front.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.