Resources

DPC DATA and Spatial Risk Systems Present Climate Risk Scoring Webinar

November 18 webinar introduced DPC's new Financial & ESG data platform and the Spatial Risk Systems methodology for scoring climate risk.

Access the webinar recording

ESG is a hot topic in the municipal market, now that credit risks stemming from the pandemic have largely abated. A recent Bond Buyer survey found 73% of the respondents rated environmental factors as either critical or very important. Furthermore, within the environmental section of ESG, climate risk is the topic people are most concerned about.

As Triet Nguyen, DPC’s VP of Strategic Data Operations, pointed out, “We’ve heard users right now feel overwhelmed by too much data, not too little, because there is an actual lack of an analytical framework. There is a need for a relatively simple scoring system to drive investment decisions. Even though the data are very, very interesting, nobody wants to look at 15 pieces of data before they can do a trade.”

Nguyen introduced DPC DATA’s new Financial and ESG data platform, MuniCREDIT Online, developed in response to these needs. This platform enables credit analysts and risk managers to perform a combined analysis of financial and climate risk factors. The data are presented and organized in a way that is instantly familiar to practitioners in US public finance. “The way we approach the ESG data, we’re focusing on the obligor, the risk at the obligor level,” stated Nguyen. “The biggest value-add for our platform is that the real world data will be mapped to the CUSIP level.”

Measuring real-world impacts

Nguyen then introduced DPC’s partners at Spatial Risk Systems, Ken Zockoll, Founder and CEO, and Ray Clarke, Chief Product Officer.

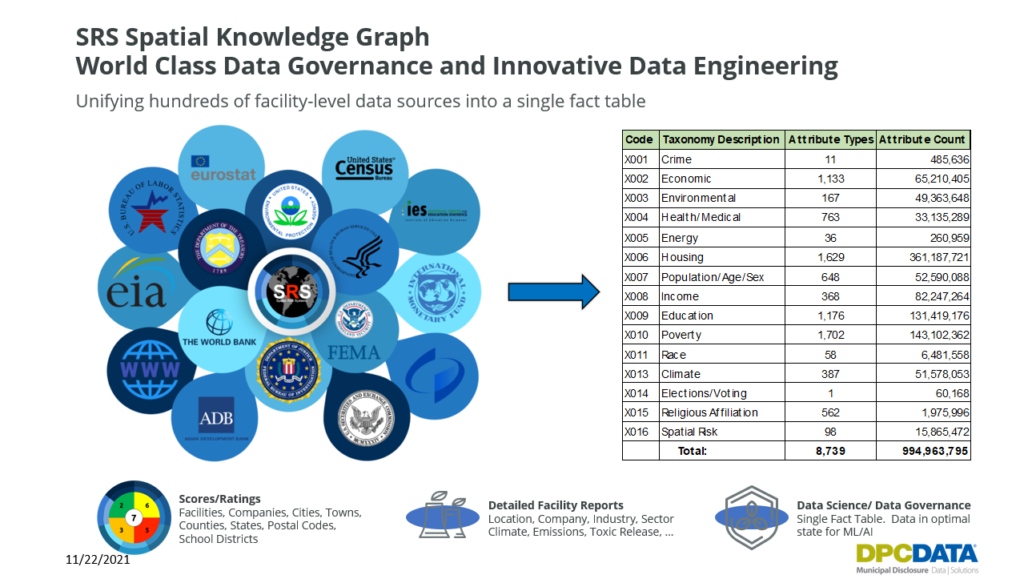

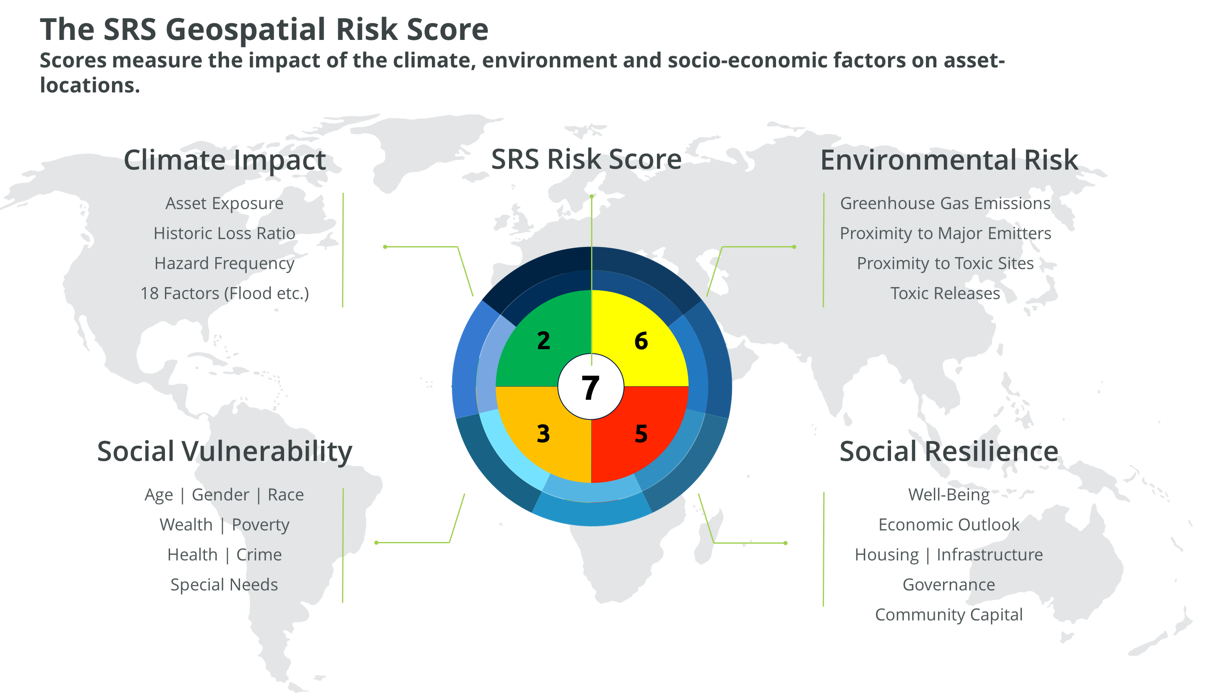

“Measuring real world impacts from climate, environmental, and socioeconomic change to government facilities and organizations from both physical and financial perspectives, is extremely difficult to measure and quantify. SRS addresses this challenge by engineering a massive spatial graph,” said Zockoll.

SRS’s AI driven assessment model can intelligently correlate and measure hundreds of underlying factors. “We standardize hundreds of facility and location level data sets into a single fact table or knowledge graph, and we encapsulate these assessments into the SRS risk scores. We have a library of about a hundred factors measuring real world impacts,” he continued.

Ray Clarke continued the presentation, walking the audience through examples of SRS risk scores for the state of Florida. He touched upon the environmental risk, climate impacts, social sustainability, and social resilience for each Florida county, pointing out which counties would be considered more vulnerable.

“SRS scores add a new dimension to municipal credit risk. We link those scores to DPC obligor codes and CUSIPs, allowing them to be appended to existing data such as pricing, terms and conditions, making it straightforward to embed into credit and portfolio related work. So a lot of the heavy lift and hard work has already been done.” Clarke noted.

Accessing climate risk scores via DPC’s tools

Users can access key SRS climate risks scores via a data feed from DPC or via MuniCREDIT Online, DPC’s web-based tool that allows users to search via Obligor or CUSIP.

“It’s useful to have a combined financial and ESG platform, because you can put the climate data in context,” said Nguyen. “As you can imagine, combining the financial and ESG data is critical, because climate risk is probably most important for the weaker, the financially weaker communities, because they don’t have as many resources to withstand any kind of climate events.”

For more details about climate risk scoring on the MuniCREDIT Online platform, contact DPC DATA at sales@dpcdata.com or 201.346.0701. View the Climate Risk Scoring webinar recording.

Get the latest advances in your inbox!

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.