Resources

MuniESG Insights | Chicago’s Sales Tax Securitization Corp: Anatomy of a Securitized Social Bond Issue

Chicago’s upcoming Sales Tax Securitization Corporation (STCS) refunding package includes the City’s first Social Bond issue. We look at the STSC’s history, its credit fundamentals, and how the Social Bond offering is structured.

January 17, 2023

The City of Chicago is coming to market with a refunding package for its Sales Tax Securitization Corporation (“STSC” or “the Corporation”), including its inaugural Social Bond issue, comprised of about $98 million Senior Lien Series 2023A and about $60 million Taxable Senior Lien Series 2023B. The bonds will carry ratings of AA- (Positive) by S&P, AA (Positive) by Fitch and AAA (Stable) by Kroll.

True Securitization or Just Another Dedicated Tax Deal?

The STSC was created back in 2017 as a legal construct designed to help the City of Chicago reduce its interest costs. At the time, the City was still an embattled credit trading at over 400 basis points spread to the AAA curve, with Moody’s the only rating agency to courageously rate the City below investment grade despite the prospect of offending and losing a potential rating client (Moody’s recently came back into the fold and restored the City’s credit to investment grade status, based on recent improvements in fiscal results).

The idea here was to create a bankruptcy-remote legal entity which would be secured by a statutory lien on a package of revenues carved out of the City’s own resources. In theory, this would be insulated from any future change in the City’s fiscal condition. The City would sell or convey all its interests in the pledged revenues, the Corporation’s bonds would no longer have recourse to the credit of the City and the resulting “securitized” structure would earn a higher rating from the rating agencies than the City itself. In this case, the pledged revenues flowing to STSC consist of Home Rule Sales Taxes and the Local Share of State Sales Taxes (certain sales taxes collected directly by the City are not pledged to the STSC bonds).

As is the case with any securitization structure, the key issue lies in whether the revenue conveyance from the City constitutes a “true sale” or just a legal maneuver without fundamental substance. Skeptics may point at the open-ended flow-of-funds, with the City receiving all the revenues in excess of the levels requited by the STSC bond indenture through a “Residual Certificate”. They may also note that the rating agencies never downgraded the underlying G.O. rating, even though the City presumably gave away a big chunk of its revenues. For now, the market is drawing comfort from all the legal steps taken by the City under advice of counsel to minimize the risk that the assets and liabilities of the Corporation will be consolidated with the City’s in a Chapter 9 scenario.

Credit Fundamentals Remain Sound, For Now

Thankfully, the “true sale” argument won’t need to be challenged anytime soon. After experiencing a significant dip at the beginning of the pandemic, pledged sales tax revenue collections have fully recovered over the last two years, a beneficiary of the online sales boom during lockdown and the rather timely Supreme Court decision in the Wayfair vs South Dakota case (2018) allowing States to tax online transactions.

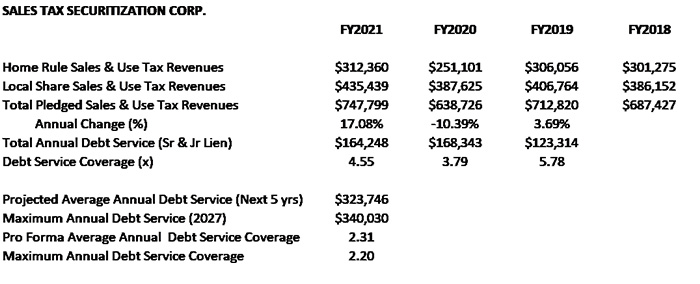

The table below summarizes the last four years’ pledged revenue collections and related debt service coverage, based on the Corporation’s financial statements:

Note that unaudited FY2022 sales tax revenues are estimated at $869.7 million, up 16% from FY2021, which would improve historical MADS coverage to 2.56x. The city projects another 5.3% increase in sales tax collections in FY2023. This may be a questionable assumption, given the widely anticipated prospect of a modest recession this year.

At last, a “By-the-Book” Social Bond Issue

In structuring its debut Social Bond offering, the City has clearly made an effort to follow the Social Bond Principles (SBP) promulgated by the International Capital Markets association (ICMA), which consist of four core components: (1) Use of Proceeds; (2) Process for Project Evaluation and Selection; (3) Management of Proceeds, and (4) Reporting.

Bond proceeds will be used to fund $150 million in projects included in the Chicago Recovery Plan (CRP). The projects cover a broad range of targets, from fleet decarbonization (actually a “green”, rather than “social” objective) to affordable housing to community development (for details, please refer to the Preliminary Official Statement).

The CRP envisions a total of $1.2 billion in new investments focusing on two major goals: “Thriving and Safe Communities” (something currently in short supply on the South Side of the City) and “Equitable Economic Recovery”.

The Department of Finance and the City Controller will oversee the allocation and management of bond proceeds, which will be held in a segregated account. The City has committed to track and report the use of proceeds and project outcomes on an annual basis on EMMA.

Last but not least, key impact metrics and outcomes are laid out upfront and will be monitored by the Project Management Office, which will publish performance reports for each project.

In a neat little twist, the City will give local residents priority access to purchasing this Social Bond issue, thus giving them an opportunity to invest in their own communities.

“Impact” versus “Risk”

As our regular readers know, we’re always careful to separate the “Risk” aspect of ESG from its “Impact”. Risk factors are usually assessed at the Obligor level, independently of the labeled bonds issued by such Obligor, and should be taken into account in credit analysis and risk management.

From a risk management standpoint, Dedicated Tax obligors should logically share the same climate and transition risk profiles as their primary government sponsors. After all, the dedicated revenues were carved out of the primary government’s total fiscal resources in the first place. In STSC’s case, securitization features notwithstanding, the same argument should apply. Ideally, investors should link this bond issue to the City of Chicago’s ESG profile in order to have a holistic view of where this deal would fit into their “Impact” framework.

For a fuller discussion of the Environmental Risk profile for the City of Chicago, please refer to our article from last summer: “City of Chicago Rising To Its ESG Challenges”.

Conclusion

As discussed, the Lightfoot Administration appears to have followed all the prescribed steps in structuring the City’s inaugural Social Bond issue to meet the ICMA standards. Since the upcoming STSC bond offering also includes non-labelled refunding series, both tax-exempt and taxable, we will have an opportunity to observe if the market will allow lower interest costs for the Social Bond series. In our opinion, the absence of a significant “greenium”, should that turn out to be the case, should provide savvy investors with an attractive relative value opportunity, assuming such investors are already comfortable with this issuer’s credit fundamentals.

Note: for more details on our MuniCREDIT Solutions, which covers over 24,000 municipal obligors across all major sectors, and on our MuniESG scores, including details on the 18 sub-components of the Climate Impact Score (hurricanes, tornadoes, wildfires, etc.) please contact us at sales@dpcdata.com.

Disclaimer: This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase and sale of any security. Although the information contained in this report has been obtained from sources we deem reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. Investors should obtain and read the official statements related to the securities discussed. All opinions are only valid as of the report date and are subject to change without notice

Stay informed

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.