Learn more about

Products

Best Practice Solutions for the Municipal Security Lifecycle

MuniCLIMATE Solutions

Actionable climate risk data to enhance municipal credit research and risk management decisions

For many institutional investors, including large pension funds and asset managers, climate change is becoming as relevant a municipal credit factor as more traditional financial elements such as liquidity or debt service coverage. Until recently, these investors lacked climate-specific data that could be used to evaluate obligors and individual bonds.

MuniCLIMATE Solutions fills this critical market need and is focused specifically on climate as a risk factor for municipals. We have partnered with two cutting-edge subject matter expert firms, First Street and Spatial Risk Systems (SRS), and integrated their climate risk data with muni financial data, all within in our proprietary Obligor and Sector Mapping System.

Clients can use our climate risk scores to assess the severity and potential cost of damage related to the bond under review, how this may affect an issuer’s tax base, and the likelihood they may need to issue more debt to rebuild or fund resiliency and mitigation efforts.

MuniCLIMATE key benefits

With MuniCLIMATE Solutions, DPC DATA has harnessed new data sources to improve our clients’ credit research and risk management decisions:

- Enhanced credit risk assessment. Adding climate data to your muni credit research and analysis enables you to spot red flags and outliers, conduct relative value comparisons, and identify risk concentrations in your portfolio.

- Climate data linked to bond holdings. We make it easy to link climate data to actual municipal bond holdings, because we have the ability to map climate scores to the correct Obligor and then to individual bond CUSIPs.

- Historical and forward-looking climate data. Our data providers have complementary data offerings and approaches so that you can access data sets aligned with your decision-making processes.

- Top-tier climate data providers. If you know DPC DATA, you know we’re picky about data integrity. We selected First Street and SRS because of their deep subject matter expertise and focus on the financial impact of climate change.

- Multiple use cases. MuniCLIMATE data can be used by issuers and sell-side capital committers, as well as institutional investors and market regulators.

Current and forward-looking climate risk data

DPC DATA sources current and 30-year forward-looking data from First Street, a research and technology group dedicated to making the connection between climate risk and financial risk. First Street’s data for flooding, wildfire, extreme heat, and severe wind risks for local governments and cities is available as a data feed from DPC DATA.

Top banks, realtors and insurance companies are increasingly using First Street’s data to assess risk at the property level. DPC DATA Inc. is helping adapt this same climate risk analysis to the muni market, to identify at-risk munis based on current and future risk profiles.

Historical climate and social risk scores mapped to Obligors

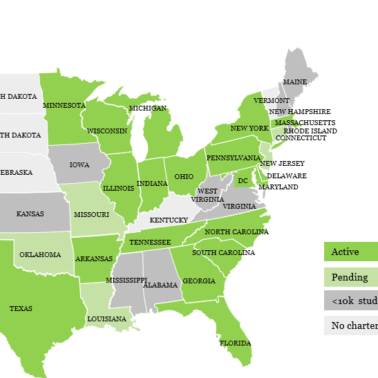

For those investors who prefer to utilize historical data with broader sector coverage, MuniCLIMATE offers Spatial Risk Systems’s climate and social risk scores for US Local Governments, School Districts and Municipal Utilities. SRS, whose cutting-edge methodology integrates geospatial data into asset risk models, scores:

- Environmental Risk

- Climate Impact

- Social Vulnerability

- Community Resilience

- Carbon Transition Liability

We map both SRS’s and First Street’s scores to the correct Obligor and individual bond CUSIPs. We also combine climate data with financial data into key ratios, so users can analyze climate exposure in the context of the municipal issuer’s overall fiscal resources and factor it into their investment process.

MuniCLIMATE Scores measure climate impact across 18 event types including coastal flooding, hurricanes, earthquakes, wildfires, drought, and strong wind. They are available as an add-on component to MuniCREDIT Online or as a separate data feed.

Learn more about MuniCLIMATE Scores.

Have a question about MuniCLIMATE Solutions?

We’ve put together the most commonly asked questions about this product offering. Check out MuniCLIMATE Solution FAQs.

Get a sample report

To talk to us about MuniCLIMATE Solutions or request a free sample report, contact your DPC DATA representative or email sales@dpcdata.com.

Sign up and get the latest news and insights about DPC DATA’s municipal bond credit, disclosure, and compliance data solutions delivered right to your inbox.