Learn more about

Products

Best Practice Solutions for the Municipal Security Lifecycle

BondVALU FAQs

Find the answers to the most commonly asked questions about the BondVALU Credit Momentum Score here.

Yield Curves & Data Vendors

How are benchmark yield curves calculated?Credit Momentum & Ratings

Should we view the Credit Momentum Scores as credit ratings, trend indicators, or something else?

What is the ‘secret sauce’ to the Credit Momentum Scores?

How often is the credit momentum data updated?

What’s the lookback period for momentum trends?

Do you use sector-specific models for credit scores?

Does a credit analyst from DPC data provide any bond analysis?

Does BondVALU cover all types of fixed-income securities?

I only care about the Credit Momentum Scores. Do I still have to complete the input spreadsheet?

Relative Value & Comparisons

What goes into the relative value comp selection?

Does DPC provide the yield for the bond being analyzed?

User Interface

Is there a cap to how many Cusips can be uploaded to the app?Product Development & Real-World Use

Why hasn’t this been done before?

Who developed this tool?

How are benchmark yield curves calculated?

We use SQX as our default curve vendor currently, but BondVALU aims to be vendor-agnostic. If you have a preferred provider, we can integrate it. The SQX muni curves are updated every hour. Corporate yield curves are spread off Treasuries and updated every 15 minutes.

Should we view the Credit Momentum Scores as credit ratings, trend indicators, or something else?

The Credit Momentum Score is not a rating and it’s not a probability of an upgrade or downgrade. It is an indicator of the strength of the underlying credit and how those underlying ratios are moving: are they strengthening or weakening? It’s essentially a screening tool to identify if the fundamentals are changing, which, paired with a credit rating, can be very helpful.

What is the ‘secret sauce’ to the Credit Momentum Scores?

Our “secret sauce” consists of the proprietary sector-based credit momentum ratios we use in our credit scoring models and the weightings we assign to each of those factors, with the calculations updated daily with the latest financial and economic data.

How often is the credit momentum data updated?

Daily. When the latest financial data submitted to EMMA are posted and verified, DPC’s data capture team usually digitizes it within hours. The scores are then updated overnight using a fully quantitative, rules-based system.

What’s the lookback period for momentum trends?

We use three years of historical financials to calculate trend direction (strengthening or weakening), consistent with common rating methodologies.

Do you use sector-specific models for credit scores?

Yes. Scoring is customized by municipal sector—state, GAAP, non-GAAP, healthcare, transportation, etc.—because each sector has different drivers and data points. DPC’s data collection methodology for municipals is also sector-specific.

Does a credit analyst from DPC data provide any bond analysis?

BondVALU is a systematic, rules-based engine. It does not rely on subjective analysts’ opinions and is driven by objective data and factors. No opinion is injected. We provide a neutral way for users to be alerted to something needing to be investigated further.

Does BondVALU cover all types of fixed-income securities?

For corporate bonds, BondVALU currently covers US domestic investment grade bonds that have publicly disclosed financial information. Other corporate bonds that are not currently covered include:

- Preferred stocks

- Convertible bonds

- Mortgage-backed securities

- Bonds issued by foreign issuers

- Private placements

- Private credit issues

- Unrated bonds with no public disclosure

- Derivatives

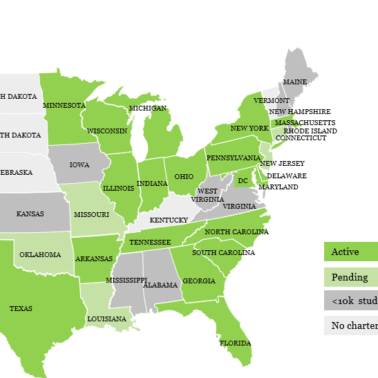

For municipals, BondVALU currently covers all investment grade bonds and selected unrated, “high yield” sectors with publicly available financial disclosure. Municipal securities that are not currently covered include:

- Issues that are backed by multiple obligors, including municipal pool programs

- Bonds issued by entities that do not commit to public disclosure

- Private placements

- Derivatives such as inverse floaters, etc.

I only care about the Credit Momentum Scores. Do I still have to complete the input spreadsheet?

No, if you just want to monitor the Credit Momentum Scores, you can just submit a list of Cusips, and leave all the other required fields blank.

What goes into the relative value comp selection?

We bucket by category (muni or corporate), maturity, call features, and rating. We’re working on more granularity (e.g., revenue vs. GO), but balance that with adding enough data to make results statistically reliable.

Does DPC provide the yield for the bond being analyzed?

No. The client provides the yield. That ensures insights match the actual offering under review, rather than generic pricing.

Is there a cap to how many Cusips can be uploaded to the app?

The current limit is 1,000 Cusips per portfolio, for up to 20 portfolios. We do have the ability to scale up, based on each client’s needs.

Why hasn’t this been done before?

Simple reason: the data wasn’t available. Muni disclosures are inconsistent and hard to extract. DPC spent years building a structured database of 28,000+ obligors. That’s what made BondVALU possible: clean data, purpose-built models, and compliance-quality review processes.

Who developed this tool?

Michael Furla, CFA, CFP, was on the team that developed this tool and today uses it actively for surveillance and client presentations. BondVALU was built with input from people working across buy-side, research, data, and tech, so it fits real-world workflows.