Learn more about

Products

Best Practice Solutions for the Municipal Security Lifecycle

BondVALU

Automated Credit Analytics for Smarter, Faster Bond Investment Decisions

Cost savings. Time savings. Revenue generation.

BondVALU’s automated credit trend scores and live yield comparisons for municipal and corporate bonds make pre-trade screening and post-trade surveillance faster, more consistent, and more scalable, so you can find better bonds and avoid unnecessary risk.

Bond selection and surveillance are too often reliant on manual, time-consuming analysis that allows you to review only a small number of bonds at a time. Introducing BondVALU, our patent-pending, automated credit analytics application, powered by DPC’s pioneering MuniCREDIT Financials and MuniCREDIT Mapping datasets. This tool gives you an easier way to:

- Identify the cheapest bonds with solid credit fundamentals to buy

- Monitor portfolios for weakening or overvalued bonds

- Automate buy lists based on quantitative criteria

- Quantify added value in basis points or dollar terms

- Streamline both investment selection and risk surveillance

- Ensure systematic, rules-based surveillance

BondVALU offers automated credit analytics for 70–80% of municipal bonds and over 95% of corporate trading volume.

Purpose-built for traders, research teams, and oversight roles

BondVALU fits the way you actually work because it was developed by professionals with buy- and sell-side, and fintech backgrounds. No other tool combines credit fundamentals and value analysis at scale. BondVALU covers 70–80% of municipal bonds and over 95% of corporate trading volume.

Trading Desks

Screen thousands of CUSIPs in seconds. Identify high-yielding bonds with solid fundamentals.

Portfolio Managers

Build ladders, manage risk, and refine allocations based on quantified data, not assumptions.

Credit Analysts

Run credit surveillance at scale. Flag at-risk bonds earlier. Free up time for deeper dives where needed.

Compliance & Risk Teams

Use BondVALU as a second set of eyes. Identify outliers, monitor for portfolio drift, and enhance audit readiness.

Client-Facing Teams

Quantify yield pickup in basis points or dollars—clear, client-ready proof of performance.

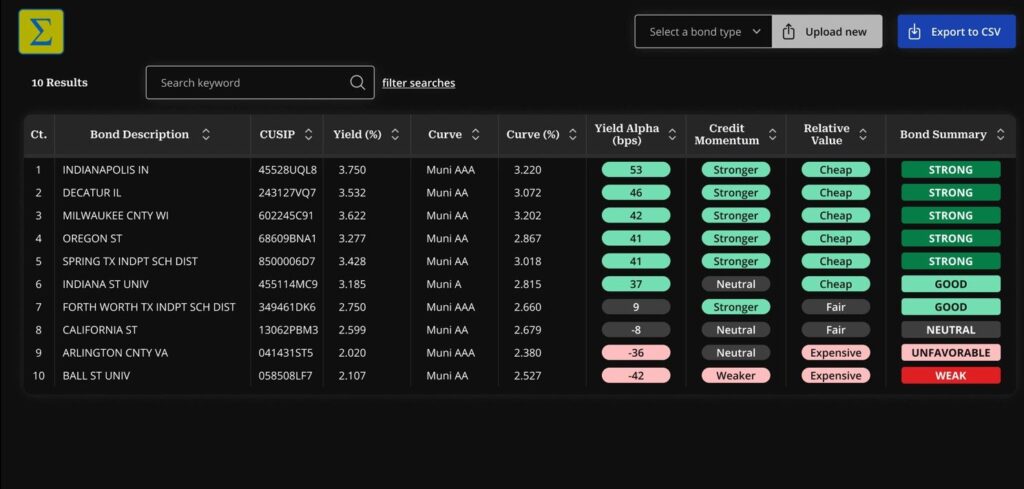

BondVALU in action

More Yield, Less Guesswork

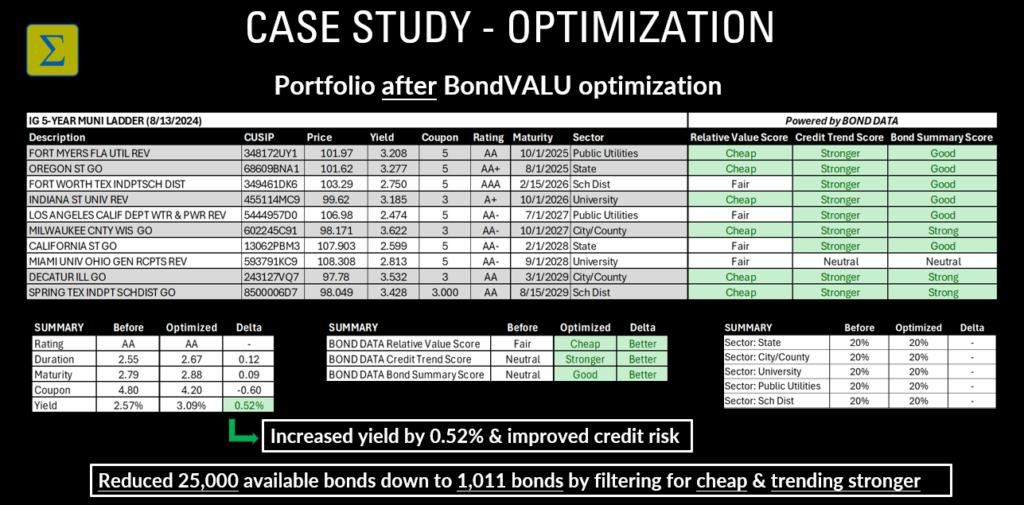

A portfolio manager used BondVALU to narrow a 25,000-bond search to 1,011 candidates with improving credit and better-than-average yield.

The result? A 10-bond ladder with the same average rating, slightly longer duration, and a 52-basis-point increase in yield. All while lowering exposure to weakening obligors.

Features built to streamline your workflows

No other product on the market currently offers this level of customizable, automated credit trend analysis across both municipal and corporate bonds.

Forward-looking credit momentum. Scores update daily using issuer fundamentals pulled from DPC DATA’s municipal credit data. Models are sector-specific, so a school district isn’t evaluated like a utility. See if credit is trending stronger, weaker, or holding steady, before the ratings go stale.

Real-time relative value analytics. Every bond is compared to a relevant benchmark curve. BondVALU calculates the yield advantage or disadvantage so you can quickly tell if a bond is priced favorably.

Bond summary score. This combines credit momentum and relative value into a single, powerful signal. It makes filtering easier when you have many bonds to analyze, so you’re not stuck manually reviewing a long list.

Smarter filtering for pre-trade decisions and ongoing surveillance. Use it before you buy to focus on bonds with improving credit and attractive yield. Use it after you buy to flag bonds in your portfolio showing signs of weakness or overpriced risk.

Customizable and scalable. API delivery makes it easy to plug into internal tools. Sector weightings can be tailored for enterprise clients who want control without having to start from scratch.

Learn more about BondVALU

Review the most frequently asked questions about BondVALU.

Contact us at 800-996-4747 or sales@dpcdata.com to learn more, schedule a walkthrough, or talk about integration.